Home / Programs / Incentives /

Urban Redevelopment Act

The Urban Redevelopment Act (URA) is Nebraska’s newest tax incentive program designed to grow small businesses and generate investment in Nebraska’s urban cores.

Apply

Before You Apply

Urban Redevelopment Act Application

How to Apply

Online URA Fee Payment

Program Resources

| Title | File Type | Date |

|---|---|---|

| Application Guide | September 27, 2022 | |

| Entity Template | Excel | July 25, 2022 |

| Memo 22-02: Qualified ERA Locations | July 21, 2022 | |

| Memo 22-03: Incentive Programs | August 16, 2022 | |

| Memo 23-01: Time of Investment | January 4, 2023 | |

| Memo 24-04: 2024 Wage Requirement | March 29, 2024 | |

| Power of Attorney Form | July 5, 2022 | |

| Pre-Application Checklist | August 9, 2022 | |

| URA Program Info | October 3, 2022 | |

| URA Wage Threshold: Memo 22-01 | December 9, 2022 | |

| Urban Redevelopment Act Calculator | Excel | July 21, 2022 |

| Urban Redevelopment Act Flyer | November 9, 2022 |

Reporting

| Title | File Type | Date |

|---|---|---|

| URA Agreements 2022: Q3 | July 26, 2023 | |

| URA Agreements 2022: Q4 | July 26, 2023 | |

| URA Agreements 2023: Q1 | July 26, 2023 | |

| URA Agreements 2023: Q2 | July 26, 2023 | |

| URA Applications 2022: Q3 | July 26, 2023 | |

| URA Applications 2022: Q4 | July 26, 2023 | |

| URA Applications 2023: Q1 | July 26, 2023 |

Frequently Asked Questions

Qualify

Q: What is the base year?

- The base year is the tax year immediately preceding the year of application.

Q: What is a base-year employee?

- Base-year employee means any individual who was employed in Nebraska and subject to the Nebraska income tax on compensation received from the taxpayer or its predecessors during the base year and who is employed at the qualified location.

Q: What is an ERA? How do I know if I am in an ERA?

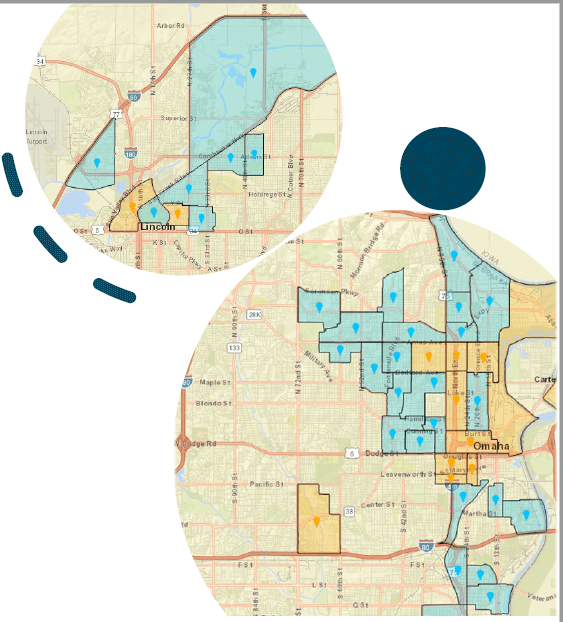

- “ERA” stands for “economic redevelopment area.” This means an area in the State of Nebraska where unemployment is at least 150% of the statewide average and where the poverty rate is 20% or more, as determined by federal census data. You can see a map of areas that meet the requirements to be qualified locations under the URA here.

Q: Does the entire investment requirement need to be made in the first year?

- No, the investment does not need to be met entirely in the first year. The investment can be made over the course of the Ramp-up Period.

Q: Does a lease of real property count as qualified investment?

- If the lease is signed after the date of application, and if the real property is part of a qualified location, then the lease will count as qualified investment. The amount of investment is calculated by taking the average net annual rent and multiplying that amount by the number of years of the lease, not to exceed ten years.

Q: Does the renewal of a lease of real property count as qualified investment?

- The renewal of a lease that would otherwise expire counts as qualified investment and follows the same rules as a new lease. The renegotiation of an ongoing lease does not count as qualified investment unless some term of the lease other than the expiration date is materially changed.

Earn

Q: When should we hire our new employees? How long do the employees have to be employed?

- Your “Ramp-Up Period” starts immediately after your application date and lasts until the end of the second year after your application date. Any FTE added during the year you filed your URA application counts toward your employment requirements. You must reach the employment levels required by your URA Agreement by the end of your ramp-up period. Once your employment and investment levels are met, you enter your performance period. The required level of employment must be maintained for all years of your performance period.

Q: When will investment count towards the agreement requirements?

- Investment in qualified property at a qualified location counts if it is made after the completed URA application is filed. Although you must meet the required minimum levels identified in your agreement with the Department of Economic Development by the end of the ramp-up period, you may continue to increase your investment and employment to earn more tax credits up to the limit listed in your agreement.

Q: Can employees working remotely qualify as new FTEs?

- Yes, as long as the teleworker’s residence is located within the same an Economic Redevelopment Area as your qualified location.

Q: What is an equivalent employee?

- Equivalent employees means the number of employees computed by dividing the total hours paid in a year by the product of forty times the number of weeks in a year. Only the hours paid to employees who are residents of this state shall be included in such computation. A salaried employee who receives a predetermined amount of compensation each pay period on a weekly or less frequent basis is deemed to have been paid for forty hours per week during the pay period. Equivalent employees are sometimes referred to as Full Time Equivalent employees, or “FTEs.”

Q: What industries are URA incentives available to?

- URA incentives are available to all industries as long as the new investment and employment occur at a qualified location. Qualified location means any location that is:

-

- Used or will be used by the taxpayer to conduct business activities, and

- Located in a city with population over 100,000, as measured by the most recent census; and

- Located within an economic redevelopment area as defined by law. You can see a map of eligible areas here.

Use

Q: What can I do with the credits?

- You will be able to claim tax credits from the Department of Revenue (DOR) once you have entered your performance period. These credits can be used:

-

- To obtain a refund of sales and use taxes

- As a refundable income tax credit

- To reduce income tax withholding employer or payor tax liability

- To obtain a refund of property taxes on real property at a qualified location

- To reduce the income tax liability of a partner, LLC member, shareholder, or beneficiary.

Limitations apply to these uses. Consult the law here for details.

Q: How long do benefits last?

- Once you have met the required levels of investment or investment and employment, your Performance Period begins. You will receive the credits for your new investment and employment during the first year of the performance period, and additional credits can be earned over the three years after that by continuing to increase employment and investment.

Apply

Q: What documents do I need for the application?

- A checklist of items needed for the application can be found under Program Resources here.

Q: Is help available to the online application if I need it?

- Definitely. You can contact us at ura.ded@nebraska.gov for assistance.

Q: If I have more than one location in an ERA, can both be in the agreement?

- Yes. The URA allows multiple locations to be part of an agreement as long as all locations are qualified locations.

Other

Q: What happens if I don’t hire before the end of my ramp-up period?

- Once you file a URA application, you will be asked to sign a written agreement that explains your obligations and what incentives you will receive in return. Your obligations will include meeting a specific level of investment, or investment and employment, by the end of the ramp-up period. If you are unable to fulfill this obligation, you will not be eligible to receive any incentives.

Q: What happens if I cannot maintain my required levels of investment or employment throughout my performance period?

- If you do not maintain the agreed levels of investment or employment for the entire performance period, Nebraska law requires the state to “recapture” any tax credits you received. The amount to be recaptured depends on how many years out of the performance period you failed to meet your employment and investment obligations.

Q: Are my employees required to be in an ERA?

- Your employees can live anywhere as long as they work at a qualified location, and a qualified location must be located in an ERA. However, you can earn an additional tax credit of $1,000 for each equivalent employee who lives in an ERA.

To stay up to date on the latest news, subscribe to the Urban Redevelopment Act email list here.

Have questions about the Urban Redevelopment Act?