Davis-Bacon and Labor Standards

What are the Davis-Bacon Labor Standards?

The State of Nebraska’s Department of Economic Development (DED) is responsible for ensuring compliance with the following Federal labor standards:

- Davis-Bacon Act:

The Davis-Bacon and Related Acts (DBRA) provides that all laborers and mechanics employed by contractors or subcontractors in the performance of construction work financed in whole or in part with Federal funds shall be paid wages at rates not less than those prevailing on similar construction in the locality as determined by the Secretary of Labor. - Contract Work Hours and Safety Standards Act:

The Contract Work Hours and Safety Standards Act requires all contractors to pay wages at a rate not less than one and one-half times the basic rate of pay for all hours worked in excess of 40 hours in any workweek, if the contract is $100,000 or greater. The wages for every mechanic and laborer employed on the job shall be computed on the basis of a standard workweek of forty hours. Employees shall be compensated at a rate of not less than one and one half times the basic hourly rate of pay for all hours worked in excess of forty hours in the work week (base rate x 1.5 + fringe benefits = overtime rate). Liquidated damages for failure to pay overtime shall be computed at the rate of $29 for each calendar day for each employee who was required or permitted to work in excess of the standard work week of forty hours without payment of the overtime wages. - Copeland Act (Anti-Kickback Law):

The Copeland “Anti-kickback” Act prohibits a federal building contractor or subcontractor from inducing an employee into giving up any part of the compensation that he or she is entitled to under the terms of his or her employment contract - Fair Labor Standards Act:

The FLSA establishes standards for employment and employee pay by business organizations and is especially applicable to construction activities. A business in the construction industry must have two or more employees and have an annual gross sales volume of $500,000 or more to be subject to the FLSA. Individual coverage applies to employees whose work regularly involves them in commerce between the states (“interstate commerce”).

HUD has provided additional guidance on how to interpret DBRA applicability for previous work, work in progress, and future work where DBRA applies for 2015-2019 CDBG-DR Grants and CDBG-MIT Grants. HUD’s guidance has impacts on completed and ongoing projects under DED’s Infrastructure Match Program as described below.

- DBRA requirements do not apply to construction work completed and performed prior to DED and HUD’s grant agreement date (July 7, 2021);

- DBRA requirements apply prospectively to construction work that began before the DED and HUD’s grant agreement date (July 7, 2021), but was still ongoing at the time of grant agreement; and

- DBRA requirements apply to prospective construction work not yet begun as of DED and HUD’s grant agreement date (July 7, 2021)

For any questions regarding DBRA applicability, please reach out to DED.

Want to Learn More?

Refer to Chapter 14: Davis-Bacon of the CDBG-DR Manual for further guidance related to this cross-cutting requirement.

The State of Nebraska’s Disaster Recovery Action Plan further articulates requirements and programmatic structures that apply to all CDBG-DR programs. For more information on Davis-Bacon and Related Acts, see HUD’s resources:

Roles and Responsibilities

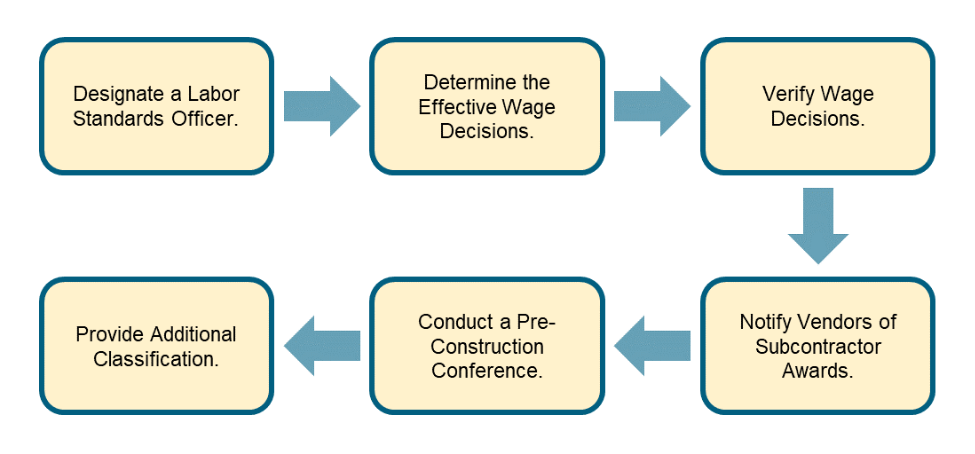

An overview of the steps for Subrecipients and Successful Applicants to carry out in maintaining Davis-Bacon compliance is provided in the figure below. These responsibilities will be primarily implemented by Subrecipients and Successful Applicants, with support as necessary from DED.

Nebraska Department of Economic and Development

DED is responsible for overseeing and monitoring Subrecipients and Successful Applicants for compliance with DBRA and submitting QPRs to HUD through DRGR. DED will designate a Labor Standards Compliance Officer (LSCO) who will be responsible for the following as further articulated in Chapter 14: Davis-Bacon of the CDBG-DR Manual:

- Confirming the specific labor standards provisions applicable to the project (e.g., Davis-Bacon wage and reporting requirements, CWHSSA, Copeland Act, FLSA) and communicating such requirements to Subrecipients and Successful Applicants;

- Determining and verifying the effective wage decision(s);

- Processing wage classification requests and reconsiderations;

- Signing off on contractor clearance;

- Creating and submitting the semi-annual report;

- Providing training and technical assistance to Subrecipients and Successful Applicants;

- Performing “spot-check” reviews of certified payroll submissions;

- Receiving and transmitting Subrecipient and Successful Applicant labor standard enforcement reports to the Department of Labor (DOL); and

- Identifying compliance violations and enforcing corrective actions for identified errors.

Subrecipients and Successful Applicants

Subrecipients and Successful Applicants who are required to maintain compliance with DBRA must designate a Labor Standards Officer (LSO) responsible for ensuring DBRA compliance. This includes, but is not limited to, the following:

- Bidding and Contracting: Subrecipients and Successful Applicants will ensure that clauses implementing DBRA, CWHSSA, FLSA, and the Copeland Act, as well as the appropriate wage determination language, are included in all construction contracts.

- Pre-Construction Procedures: Prior to construction and issuing a Notice to Proceed, Subrecipients, Successful Applicants, and LSOs may schedule a pre-construction conference with the selected contractor, subcontractors, and bookkeeping/payroll staff to review all Federal labor standards requirements and to provide all required documents identified on the Pre-Construction Conference Checklist.

- Monitoring during Construction: Subrecipients and Successful Applicants are responsible for enforcing labor standards requirements during construction by completing payroll reviews, ensuring the prime contractor is completing all required reporting, conducting a minimum of two on-site job interviews, comparing the Record of Employee Interview form to contractor/subcontractor payroll information, identifying discrepancies, documenting corrective actions, and investigating wage complaints.

- Tracking Records and Ensuring Compliance to Labor Standards: Subrecipients and Successful Applicants are responsible for tracking records and monitoring compliance with labor standards.

An overview of these activities is provided below. A full description of requirements for LSOs is provided in Chapter 14: Davis-Bacon of the CDBG-DR Manual.

Bidding and Contracting

Activities completed by Subrecipients and Successful Applicants while bidding and contracting include:

-

Ensuring the current Davis-Bacon wage decision and contract standards are incorporated into the contract for construction;

-

Searching www.sam.gov/content/wage-determinations no more than 10 days prior to a bid opening to ensure the wage decision in the bid is current and notify DED of the bid package’s status;

-

Submitting contractors for clearance to DED and receiving approval from DED prior to beginning work;

-

Utilizing Historically Underutilized Businesses, small and minority-owned businesses, women’s business enterprises, Section 3 businesses, and labor surplus firms when possible; and

-

Notifying DED of a wage classification change if a worker classification does not appear on the executed wage decision.

Pre-Construction Procedures

Activities completed by Subrecipients and Successful Applicants in the pre-construction phase include:

-

Scheduling and conducting a Pre-Construction Conference with contractors and any selected subcontractors to review the information included in the Pre-Construction Conference Checklist (optional);

-

Issuing a Notice to Proceed to the prime/general contractor to begin construction; and

-

Ensuring that no contract is awarded to any contractor that is debarred or otherwise ineligible to participate in Federal programs.

Contractors

Contractors and subcontractors serve a vital role in ensuring compliance with Federal labor standards, including:

-

Recording Employee Information: Contractors must record new employees using DED’s New Employee Information Form and E-Verify to ensure compliance with the Davis-Bacon wage rate determination.

-

Payroll: The prime contractor is responsible for ensuring compliance by reviewing payroll reports for their employees as well as the employees of any subcontractors on the project. Additionally, the prime contractor is responsible for submitting the Statement of Compliance (a.k.a. a Certified Payroll Report or CPR) to DED.

-

Request for Payment: When submitting requests for progress or final payments, the prime contractor must ensure that all weekly payroll reports and CPRs have been submitted to Subrecipients or Successful Applicants. Note that the Subrecipient or Successful Applicant will be responsible for ensuring employee interviews have been conducted and checked against payrolls and wage rate decisions, and any discrepancies identified in the payroll reports or job site interviews have been resolved.

-

Reporting: Contractors and subcontractors are responsible for the submission of payroll forms, weekly CPRs, and semi-annual labor standards enforcement reports to document compliance.

Monitoring During Construction

Subrecipients and Successful Applicants are required to conduct monitoring during construction. Monitoring activities include:

- Conducting on-site interviews;

- Conducting field inspections at the job site to establish compliance with labor requirements;

- Receiving and transmitting labor standard enforcement reports to DED for transmission to DOL or HUD;

- Enforcing the referral of potential criminal/complex investigations, debarment, or CWHSSA liquidated damages to HUD; and

- Establishing a complaints process and assure worker complaints are addressed promptly

Tracking Records and Ensuring Compliance to Labor Standards

Subrecipients and Successful Applicants are responsible for tracking records and monitoring compliance with labor standards. Tracking records and monitoring compliance records include:

-

Demonstrating compliance with labor standards requirements by submitting quarterly reports to DED in AmpliFund;

-

Researching and resolving labor violations;

-

Assessing liquidated damages;

-

Setting up wire transfers to liquidated damages and unfound workers;

-

Reviewing payrolls for restitution;

-

Notifying DED of a wage classification change if a worker classification does not appear on the executed wage decision;

-

Preparing reports on all enforcement activities;

-

Reviewing all weekly payrolls and Statements of Compliance to resolve any discrepancies;

-

Confirming employee interviews have been conducted as necessary and checked against payrolls and the wage rate decisions;

-

Disposing of deposit/escrow accounts established for labor standards purposes; and

Maintaining full documentation of all labor standards administration and enforcement activities for no less than three (3) years after the completion of construction or final disposition of any compliance issues, whichever occurs last.

Recording Employee Information

Contractors must record new employees. This includes the following:

- Complete DED’s New Employee Information Form for each apprentice, trainee, or volunteer, as applicable; and

-

Use E-Verify to confirm the eligibility of employees to work in the United States.

Payroll

Once construction is underway, the prime contractor is responsible for the full compliance of all subcontractors on the project and is held accountable for any wage restitution that may be necessary. Prime contractors must:

-

Review payroll documentation to ensure there are no discrepancies or underpayments;

-

Complete weekly payroll reports for internal employees and the employees of any subcontractors; and

-

Sign the CPRs for internal employee weekly payroll reports and obtain signed CPRs for any subcontractors. This is due no more than 10 business days following the end of the payroll period.

Request for Payment

When a contractor is prepared to submit a request for progress or final payment(s), Subrecipients and Successful Applicants will monitor contractor compliance with all Federal labor standards. To ensure a request for payment is successful, contractors should:

-

Confirm that all internal and subcontractor weekly payrolls and CPRs have been submitted and any discrepancies have been resolved;

-

Verify that employee interviews have been conducted as necessary, checked against payrolls and wage rate decisions, and all discrepancies have been corrected; and

-

Provide complete and accurate files documenting Federal labor standards compliance.

Reporting

Contractors are responsible for the submission of the following reporting requirements to Subrecipients and/or Successful Applicants:

-

Weekly payrolls;

-

Weekly Statement of Compliance, or Certified Payroll Reports (CPRs); and

-

Semi-annual labor standards enforcement reports.

Frequently Asked Questions

Q: Which programs must comply with these requirements?

A: The Davis-Bacon and Related Acts (DBRA) is a crosscutting federal requirement is applicable to the Infrastructure Match Program (except for the projects as listed above) and the Affordable Housing Construction Program.

Q: When does Davis-Bacon apply?

A: DBRA applies to all federally-funded or assisted construction contracts in excess of $2,000 and when CDBG-DR funding is used for the construction or rehabilitation of a residential project with eight (8) or more residential units.

Contact Information

Questions and comments regarding CDBG-DR programs should be directed to the State of Nebraska’s Department of Economic Development (DED) via email at ded.cdbgdr@nebraska.gov or by calling (800)-426-6505.