Homeownership Production Program

Purpose

The Homeownership Production Program (HPP) provides development financing to support the production of affordable for-sale housing targeted to LMI buyers by covering:

- Appraisal gaps: The difference between the total development cost and market value, sometimes referred to as “development subsidy.”

- Affordability gaps: The difference between an eligible buyer’s purchasing power and the market value of the house.

- Financing gaps: The difference between the total development financing needed and the Applicant’s ability to obtain third-party construction financing and/or provide its own working capital.

Community Development Block Grant Disaster Recovery (CDBG-DR) funds are used initially to reimburse development costs ranging from acquisition to hard construction to soft costs. Homes are then sold to income-eligible buyers. At the end of the project, total sources and uses are reconciled and program funding is allocated as a development subsidy (i.e., addressing the “appraisal gap” between total costs and appraised value), for direct buyer assistance (i.e., the “affordability gap” between a buyer’s purchasing power and total cost of their acquisition at market value) with any remaining CDBG-DR funds returned to the Department of Economic Development (DED) as program income which is reinvested in additional CDBG-DR activities.

The included buyer assistance is secured in the form of a second mortgage that is forgivable over a five (5) year affordability period provided the purchaser continues to occupy the home as their primary residence.

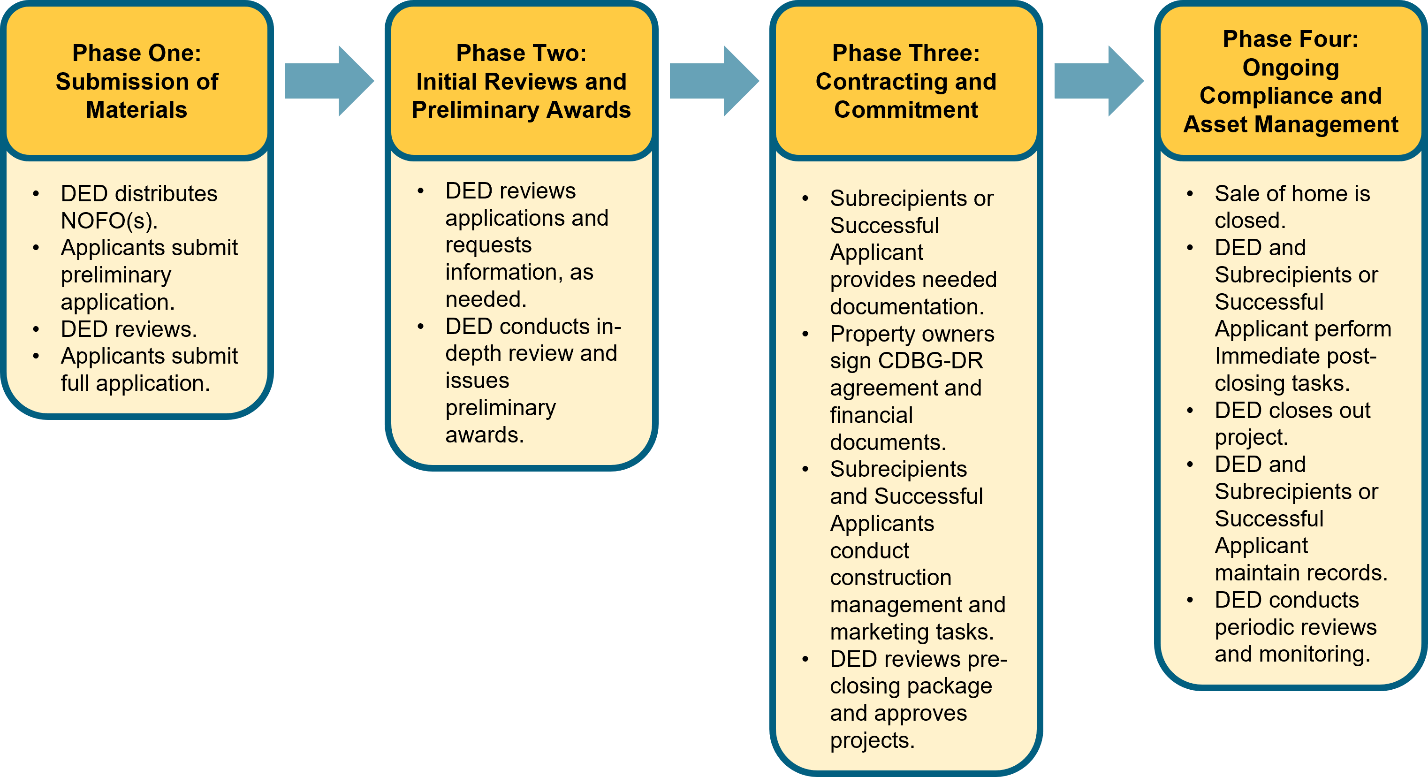

Process Overview

Want to Learn More?

For a full overview of the program, see the Affordable Housing Construction: Homeownership Production Program Guide.

Cross-Cutting Requirements

This section includes icons that capture CDBG-DR cross-cutting program requirements.

-

Blue icons indicate requirements that Subrecipients must meet under HPP. Click on each icon’s hyperlink for more information.

- Gray icons indicate requirements that do not apply to the HPP but may apply to other programs.

Homeownership Production Program Roadmap

This section is organized into four (4) phases:

Phase 1: Submission of Materials

Notice of Funding Opportunity (NOFO)

DED distributes an NOFO.

Preliminary Application

Applicants submit preliminary application via AmpliFund.

How to Apply to HPP: DEVELOPERS

DED expects that most applicants will be non-profit organizations, but local government entities and for-profit entities are also eligible to apply. Any entity that is awarded under HPP is a Successful Applicant.

Applications are not currently open at this time. This webpage will be updated with information and training for the application process when it is opened.

Consistent with HUD guidance, an active registration in the System for Award Management (SAM) is required to apply for an award and for DED to make a payment with HUD funds. Any entity applying for funds from DED (whether government, for-profit, or non-profit) must have a Unique Entity Identifier (UEI) An entity must maintain an active listing on sam.gov to be eligible for an award, and throughout the term of any associated funding agreement involving CDBG-DR funds. It is recommended that entities maintain a public (not private) listing as those listed only privately may experience application and payment processing delays. may experience application and payment processing delays.

How to Apply to HPP: HOMEOWNERS

Homeowners will apply directly to local Successful Applicants to receive direct buyer assistance toward the purchase of an HPP-funded home. DED will not distribute funds directly to individual homeowners.

Helpful Resource(s)

HPP Application

Review

DED will review preliminary applications if submitted. Preliminary applications are encouraged; however, they are not required.

Full Application

Applicants complete and submit full application via AmpliFund.

Phase 2: Preliminary Awards

Preliminary Eligibility Determination

DED reviews full applications for compliance and eligibility. If all necessary information is provided, DED conducts an in-depth review for compliance and eligibility and makes a preliminary eligibility determination. If additional information is needed, DED conducts outreach with applicants.

In-Depth Review

If all necessary information is provided, DED conducts in-depth review for compliance and eligibility and makes a preliminary eligibility determination. If additional information is needed, DED conducts outreach with applicants via email.

Preliminary Award

DED issues a Notice of Intent to Award (i.e., preliminary award) to selected Applicants; selected Applicants move on to Phase 3 of the roadmap. Applicants not selected for an award are notified in writing.

Phase 3: Contracting and Commitment

Project Management

DED assigns the Subrecipient or Successful Applicant to a DED Project Manager.

Project Categorization

DED, in consultation with the Subrecipient or Successful Applicant, will determine how proposed production will be categorized into one or more “projects.” DED may fund in a series of projects, even on a house-by-house basis, taking into consideration factors including, but not limited to, whether:

-

Property is being acquired simultaneously from a single seller or sequentially from multiple sellers;

-

Houses will be built simultaneously and/or by a single general contractor (vs. built in phases);

-

Houses are located on contiguous lots (e.g., whole subdivision), relatively “concentrated” lots within a given neighborhood, or on scattered infill sites across a broader area; and

-

Homes are “pre-sold” or being built speculatively (DED will particularly limit spec building).

Additional Documentation

The Successful Applicant submits necessary additional documentation for final underwriting, special conditions of the Preliminary Award, and development loan items.

CDBG-DR Agreement

Owners of projects sign a CDBG-DR Funding Agreement with DED and relevant financial documents, as needed. In some cases, an award may be split into a series of projects where DED provides funding incrementally as houses are built and sold. In this case, there may be multiple CDBG-DR Funding Agreements and loan documents.

Helpful Resource(s)

- CDBG-DR Developer Funding Agreement example

- CDBG-DR Developer Note

- CDBG-DR Developer Deed of Trust

Construction

Once the development loan has been obtained between DED and the Successful Applicant, the Successful Applicant may proceed with acquisition and construction/rehabilitation, drawing funds as reimbursement for eligible expenses.

Successful Applicant conducts outreach and hiring activities in compliance with CDBG-DR policies and procedures (e.g., Section 3, Davis-Bacon, MBE/WBE) as applicable.

Drawing Funds

Proceeds of the CDBG-DR funded HPP Development Loan will only be released to an Applicant for reimbursement of eligible project costs, with supporting documentation for actual costs incurred. For more information on conditions of periodic draws, see the ACHP Homeownership Production Program Guide.

Inspections

Prior to each draw, DED will conduct inspections.

Marketing

Even while houses are under construction, Successful Applicant will conduct marketing tasks, including but not limited to affirmatively marketing, identifying and qualifying buyer, and submitting obtaining DED’s approval prior to closing on sales with individual buyers.

Pre-Closing Package and Approval

DED reviews sale pre-closing package, particularly reviewing buyer information and buyer underwriting analysis to confirm income/program eligibility and to review updated project-level financial data (e.g., final construction costs, actual use of other funds and draw of CDBG-DR, etc.).

Once a specific buyer is approved for a house, DED prepares and issues lien discharge and instruction letter for title/closing agent.

Phase 4: Program Implementation and Administration

Closing

At closing of the sale to an approved LMI homebuyer, the following will occur:

- Buyer executes CDBG-DR Homebuyer Agreement, Note, and Deed of Trust, with copies submitted to DED;

- Closing agent provides and the Successful Applicant ensures submission of closing disclosure/settlement statement; and

- Closing agent disburses any required repayment of Successful Applicant’s CDBG-DR loan to DED.

Helpful Resource(s)

- CDBG-DR Homebuyer Written Agreement

- CDBG-DR Homebuyer Note

- CDBG-DR Homebuyer Deed of Trust

- Sales Agreement Rider

- Homebuyer Income Verification Package

- First Mortgage Certification

Project Management

The Successful Applicant uses funds to reimburse development costs. Upon completion of construction, homes are sold to income-eligible buyers who may receive direct homebuyer assistance toward their down payment, closing costs, and/or “buying down” their first mortgage to an affordable level which is secured by a second mortgage.

Following sale of each unit, DED and the Successful Applicant reconcile the as-completed sources and uses for the project, determining how much program funding was needed as a development subsidy and for direct buyer assistance and returning any excess sales proceeds to DED as program income.

Immediate Post-Closing

Successful Applicant submits copy of recorded mortgage to DED.

Successful Applicant submits, and DED approves:

- Final proforma, reconciling to actual final buyer/seller closing costs and other “day of” adjustments; and

- Any final payment due DED.

Closeout

DED staff determines if a project is eligible for closeout for the CDBG-funded portion of the project.

Subrecipient or Successful Applicants return any funds recaptured from assisted buyers who sell their homes within the affordability period to DED as program income. DED reinvests program income in additional CDBG-DR activities.

Record Retention

DED and the Subrecipient or Successful Applicants schedule document retention based on determined closeout date.

Subrecipient or Successful Applicant maintains records identified in the AHCP Recordkeeping Package for at least three (3) years following the Affordability Period. DED maintains records for at least ten (10) years following the closeout. Refer to the Affordable Housing Construction Program: Homeownership Production Guide and Chapter 17: Recordkeeping & Data Management of the CDBG-DR Manual for further guidance on which records need to be kept.

Helpful Resource(s)

- AHCP Recordkeeping Package

Monitoring

Development and Sales Period

DED oversees periodic remote and on-site project monitoring of the Successful Applicant’s performance during the development and sales period. As part of this monitoring, DED staff reviews financial performance (i.e., review and approve withdrawals and ensuring payment collection).

Affordability Period

During the affordability period for the homes produced, DED will conduct remote and/or on site monitoring of Subrecipient or Successful Applicant’s ongoing servicing of CDBG-DR homebuyer assistance loans and their oversight of buyers’ ongoing occupancy.

During the affordability period for the homes produced, Subrecipient or Successful Applicant:

- Monitors ongoing owner-occupancy annually;

- Processes any payoff requests (payoff for less than balance requires DED approval), remitting funds received to DED and executing/recording lien discharges;

- Processes any requests for subordination, approving as appropriate; and

- Reports annually to DED on these activities.

Helpful Resource(s)

- Quarterly Progress Report form; and

- Annual Report (post-sale of all units) form.

After Affordability Period

For buyers who remain in place, Successful Applicant discharges liens and provides notice and copies of same to assisted buyers.

Frequently Asked Questions

The State of Nebraska DR-4420 CDBG-DR Affordable Housing Construction Program Frequently Asked Questions (FAQs) guide contains answers to FAQs.

Contact Information

Questions and comments regarding CDBG-DR programs should be directed to the State of Nebraska’s Department of Economic Development (DED) via email at ded.cdbgdr@nebraska.gov or by calling (800)-426-6505.