LIHTC Gap Financing Program

Purpose

The purpose of the Community Development Block Grant Disaster Recovery (CDBG-DR) Low Income Housing Tax Credit (LIHTC) Gap Financing Program is to provide gap financing to affordable multi-family housing production projects seeking LIHTC awards from the Nebraska Investment Finance Authority (NIFA). In all cases under the LIHTC Gap Funding program, Successful Applicants will be for-profit “developers” for CDBG-DR regulatory purposes as LIHTC project owners must be for-profit entities to benefit from tax credits.

Process Overview

Want to Learn More?

For a full overview of the program, see the Affordable Housing Construction: LIHTC Gap Financing Program Guide.

Cross-Cutting Requirements

This section includes icons that capture CDBG-DR cross-cutting program requirements.

-

Blue icons indicate requirements that Subrecipients must meet under this program. Click on each icon’s hyperlink for more information.

- Gray icons indicate requirements that do not apply to this program but may apply to other programs.

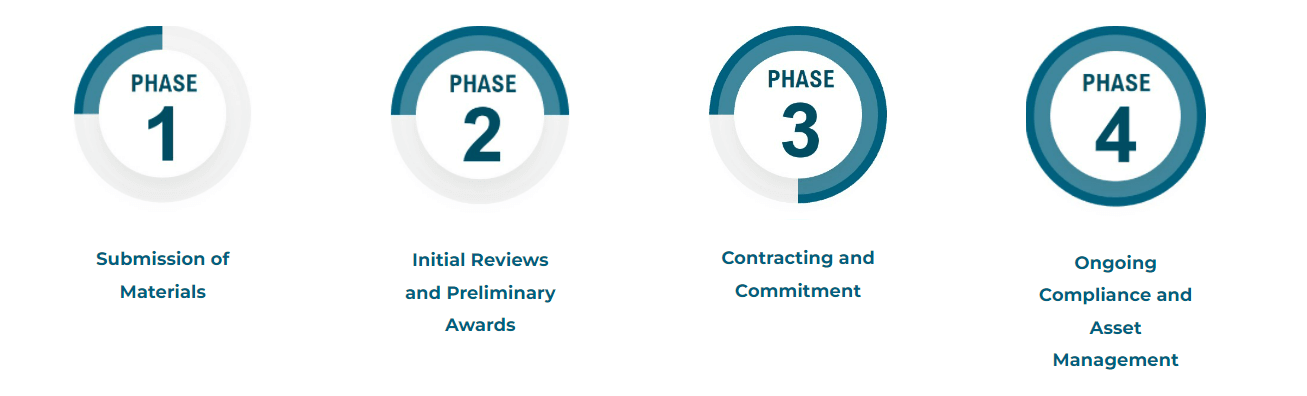

CDBG-DR LIHTC Program Roadmap

This section is organized into four (4) phases:

Phase 1: Submission of Materials

Preliminary Application

DED will accept applications in concert with NIFA through a combined application process that allows Applicants to simultaneously submit requests for CDBG-DR and LIHTC funds.

Consistent with HUD guidance, an active registration in the System for Award Management (SAM) is required to apply for an award and for DED to make a payment with HUD funds. Any entity applying for funds from DED (whether government, for-profit or non-profit) must have a Unique Entity Identifier (UEI). An entity must maintain an active listing on sam.gov to be eligible for an award, and throughout the term of any associated funding agreement involving CDBG-DR funds. It is recommended that entities maintain a public (not private) listing as those listed only privately may experience application and payment processing delays. experience application and payment processing delays.

Helpful Resource(s)

Relevant Links

Review

DED and NIFA review preliminary applications to ensure applications meet threshold requirements. DED may send CDBG-DR information requests for supplemental material to Applicants, if needed, or provide comments on preliminary application materials. Preliminary applications are optional but strongly suggested.

Full Application

Applicants complete and submit full application via NIFA’s online LIHTC application collector but may later be required to provide additional information in DED’s AmpliFund system.

Helpful Resource(s)

- Acknowledgement and Exception Request

Phase 2: Initial Reviews and Preliminary Awards

Preliminary Eligibility Determination

DED and NIFA will review and analyze completed LIHTC and CDBG-DR applications for compliance and eligibility. If all necessary information is provided, DED and NIFA will make a preliminary eligibility determination. If additional information is needed, DED may contact the Applicant for additional information.

Helpful Resource(s)

- Prioritization Checklist

Preliminary Award

DED issues a Notice of Intent to Award (i.e., preliminary award) to selected Applicants; selected Applicants move on to Phase 3 of the roadmap. DED will provide written notice to Applicants not selected for a preliminary award.

Phase 3: Contracting, Commitment, and Closing

Project Management

DED assigns the project to a DED Project Manager.

Additional Documentation

Developers submit necessary additional documentation for final underwriting, special conditions of the Preliminary Award, and pre-closing items. DED will provide developers with a Due Diligence/Pre-Closing Checklist and update it throughout the underwriting process.

Helpful Resource(s)

- General Due Diligence/Pre-Closing Checklist

CDBG-DR Agreement

Owners of projects sign a CDBG-DR Agreement with DED and relevant financial documents, as needed.

Helpful Resource(s)

- CDBG-DR Agreement

- CDBG-DR Declaration of Restrictive Covenant

- CDBG-DR Note

- CDBG-DR Deed of Trust

- Completion Guaranty

- Performance and Recovery Guaranty

- Replacement Reserve Guaranty

Construction Management

After closing, owners will proceed with construction of the project, including requesting periodic draws against their CDBG-DR loans. DED also requires owners to submit periodic reports on project progress, barriers, and the like. DED provides CDBG-DR funds to the project owner on a reimbursement basis, with documentation of costs incurred. Owners will usually submit reimbursement requests to DED monthly.

Inspections

Prior to each fund drawdown, DED will conduct inspections.

Helpful Resource(s)

- ACHP Quarterly Progress Report

Phase 4: Ongoing Compliance and Asset Management

DED Staff

Project is assigned to DED compliance and asset management staff.

Affirmatively Marketing and Lease Up Tasks

This step spans across Phase 3 and Phase 4, as affirmative marketing and lease-up tasks typically begin while construction (i.e., Phase 3) is in its latter stages and then throughout the period of affordability once the project is placed in service (i.e., Phase 4).

Marketing and lease up tasks broadly include:

- Marketing the project to potential tenants, including affirmative marketing efforts to those groups that are least likely to apply;

- Screening applicants for income eligibility and applying appropriate tenant selection and preferences (as applicable);

- Ensuring compliance with applicable state and federal requirements, including but not limited, to state landlord/tenant laws, CDBG-DR and LIHTC affordability and income determination requirements, applying appropriate rent limits, providing for reasonable accommodations, fair housing statutes, and other similar requirements; and

- Managing the landlord tenant relationship, renewing leases with carry over tenants, and the like.

Helpful Resource(s)

- Lease Addendum

- Rental Management Handbook

Monitoring

During the Affordability Period, DED compliance and asset management staff will annually monitor projects for ongoing compliance with the income and rent restrictions, as well as other ongoing requirements associated with CDBG-DR funding (e.g., affirmative marketing) and review financial performance (i.e., review and approve withdrawals from project reserves and ensuring payment to DED as required). In practice, DED compliance and asset management staff will employ both periodic remote and on-site project monitoring.

Helpful Resource(s)

- Annual Rent and Utility Allowance Approval Form(s)

- Annual Owner’s Report

Record Retention

Subrecipients maintain records identified in the AHCP Recordkeeping Package for at least three (3) years following the Affordability Period. DED maintains records for at least ten (10) years following the closeout. Refer to the Affordable Housing Construction Program Guide: CDBG-DR LIHTC Gap Financing and Chapter 17: Recordkeeping & Data Management of the CDBG-DR Manual for further guidance on which records need to be kept.

Helpful Resource(s)

- AHCP Recordkeeping Package.

Frequently Asked Questions

The State of Nebraska DR-4420 CDBG-DR Affordable Housing Construction Program Frequently Asked Questions (FAQs) (if this link is broken, please search for the file here) guide contains answers to FAQs.

Contact Information

Questions and comments regarding CDBG-DR programs should be directed to the State of Nebraska’s Department of Economic Development (DED) via email at ded.cdbgdr@nebraska.gov or by calling (800)-426-6505.